And then we're um saving our copy of this right yeah it'll save to the local computer here then we'll have to move it with usb okay okay here we got our first question i assume you guys are wearing the video and audio feed are coming through they're all well there is it open mike it is now because we turned it on don't worry thank you for letting us know it's working okay just let me know if you need anything i don't know all about this but i might be able to help yeah i'll be right back there we go expand this a little bit i'll get rid of these there you go you're off now you're good to go okay i'm sure okay hello everybody um so they're all muted so you won't hear them okay thank you matthew so hello and welcome my name is janice and i'm the managing attorney of the low income taxpayer clinic here at maryland volunteer lawyer service we are delighted to welcome stephen kaufman who is going to be talking to us about the federal payroll tax case i hope you can all hear me um there is a section there for questions so if you do and stephen is welcoming questions throughout the talk so please feel free to write in your question and we'll read it aloud and stephen will answer it then so okay here we go thanks jen um hi i understand that the attendees include attorneys and cpas and enrolled agents and uh i feel kindred spirit with you guys i've been practicing law for 30 years plus or minus but um before i practiced law i went to loyola college and i majored in accounting and when i graduated from loyola i...

PDF editing your way

Complete or edit your visa countries to usa anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export visa travel to usa directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form 870 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your visa waiver program usa by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

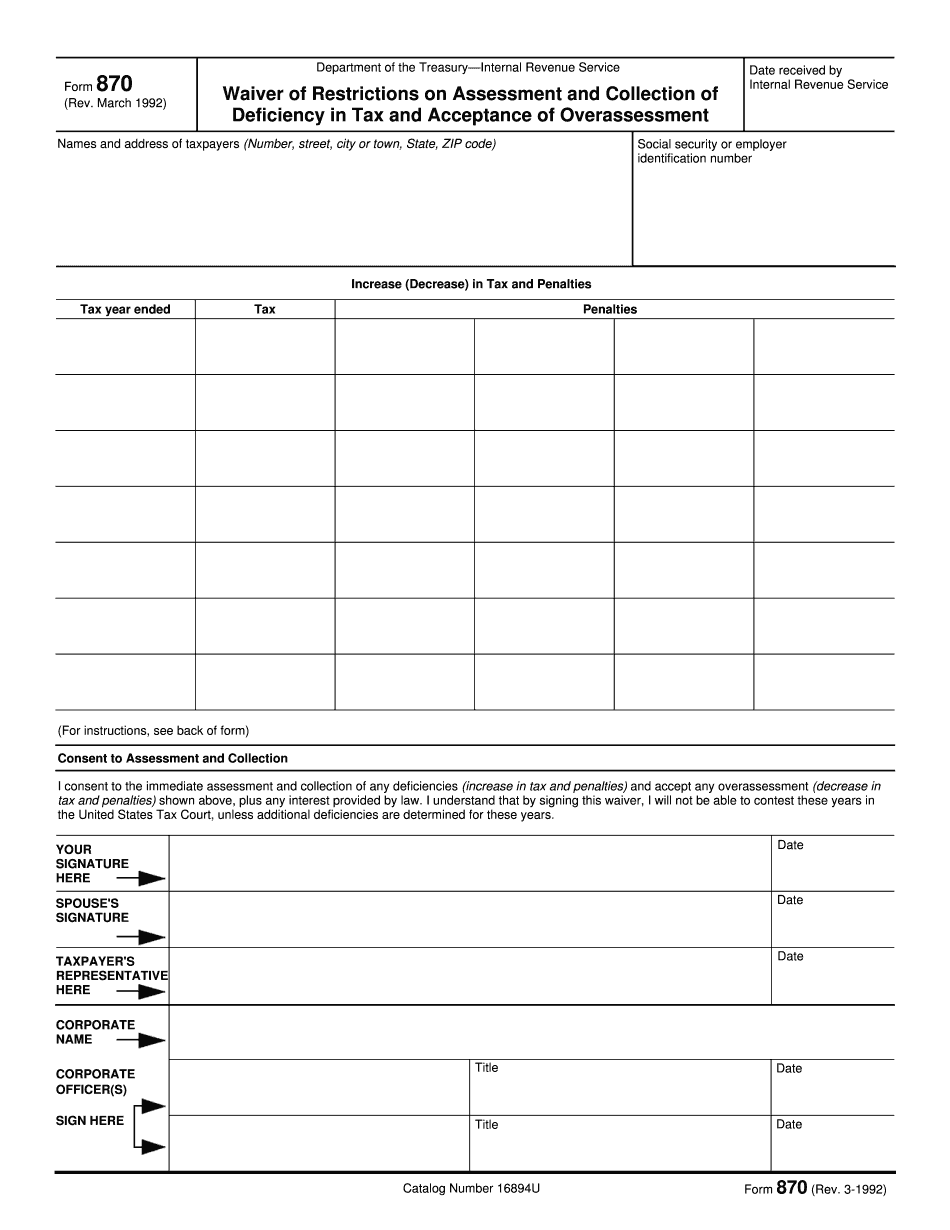

How to prepare Form 870

About Form 870

Form 870 is a legal document used in the United States by taxpayers who want to settle disputes regarding the amount of income tax they owe. It is specifically used for the purpose of reaching an agreement between the taxpayer and the Internal Revenue Service (IRS) on an agreed-upon amount of tax to be paid, thus avoiding a lengthy and costly tax court trial. The taxpayer typically initiates the process by submitting Form 870 to the IRS. It provides a framework for negotiating and finalizing the resolution of tax disputes, highlighting the agreed-upon deficiencies or underpayments. The form includes various sections that allow the taxpayer to specify the agreed-upon tax amount, any penalties or interest due, and methods of payment. Form 870 is primarily used by individuals, businesses, or other entities who are being audited by the IRS and wish to reach a settlement instead of going to tax court. It is essential for taxpayers who want to resolve their tax disputes promptly and efficiently while minimizing potential legal costs. However, it is important to note that tackling tax matters, including Form 870, can be complex. It is advisable to seek professional assistance from tax attorneys, certified public accountants (CPAs), or enrolled agents to ensure a fair and favorable outcome.

What Is Irs Form 870 Ad?

Online technologies enable you to arrange your document management and strengthen the productivity of the workflow. Look through the short guideline so that you can fill out Irs Form 870 Ad, avoid errors and furnish it in a timely manner:

How to complete a Irs 870 Ad Form?

-

On the website hosting the blank, click on Start Now and pass for the editor.

-

Use the clues to complete the relevant fields.

-

Include your individual data and contact information.

-

Make sure that you enter proper data and numbers in suitable fields.

-

Carefully check out the data in the document so as grammar and spelling.

-

Refer to Help section in case you have any issues or address our Support staff.

-

Put an digital signature on your Irs Form 870 Ad printable with the support of Sign Tool.

-

Once document is finished, press Done.

-

Distribute the prepared form through electronic mail or fax, print it out or save on your device.

PDF editor lets you to make improvements towards your Irs Form 870 Ad Fill Online from any internet connected gadget, personalize it in accordance with your requirements, sign it electronically and distribute in several means.

What people say about us

It's a great idea to send forms online

Video instructions and help with filling out and completing Form 870