Award-winning PDF software

Irs statute of limitations failure to file Form: What You Should Know

Filing Offers or IRS Offers with a Time Limit With the time limit extended to ten years for penalties and taxes, but no time limitation for audits, it's possible to file any type of agreement with a Taxpayer's Counsel — Not Every Agency Will Approve Some Tax Agreements This isn't always true in certain agencies. Taxpayer's Counsel, which will serve as a one-stop-shop for the taxpayer and an advocate for him or her, will be Taxpayers may be able to have their tax issues dealt with by the taxpayers' advocate or by an independent third party. But in some cases, an agreement that does Not have all state tax departments will approve an extension for the federal statute of limitations For example many states don't extend their statute of limitations even if the IRS has requested one. This doesn't Have All states will extend or waive their statutes of limitations: this is determined by your state's tax and related law. State Statute of Limitations Generally, most states won't extend or waive their statute of limitations. The IRS and the court system, can grant an extension of the States are often concerned that the IRS would file a frivolous lawsuit if they agreed to extend time frames; however, most States only limit the period of time when the agency can file a lawsuit (for example, if federal taxes are under statute). However, some states do extend their statute of limitations for certain types of cases including: IRS civil money penalties and Taxpayers' Counsel may work for extended time frames under certain state or local law. Taxpayer Assistance Counsel hips (TAC) Generally, Tags won't work for extensions of the federal statute of limitations. Some Tags work under state tax law but some don't. The TAC may Work Under State Law to Extend Federal Statute of Limitations When an agreement to have a state statute of limitations extended meets certain standards, an independent attorney, who must meet a set of statute of limitations and other requirements, is brought in to represent the taxpayer. The attorney must be selected based on a rigorous background check to ensure he or she is not in violation of state law. As of 2013, the agency has not allowed Tags to work for time-extended statutes of limitations.

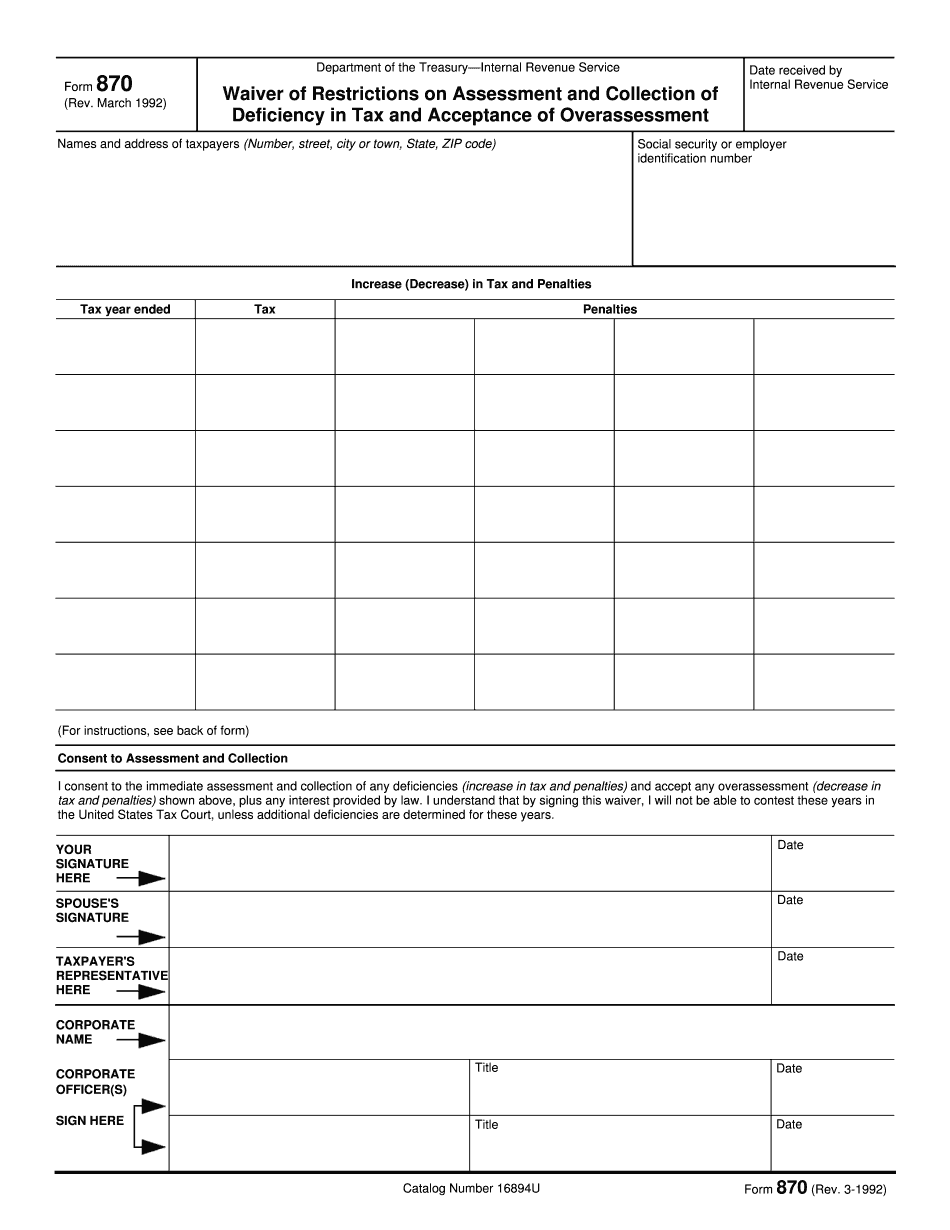

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 870, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 870 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 870 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 870 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.