Award-winning PDF software

AK Form 870: What You Should Know

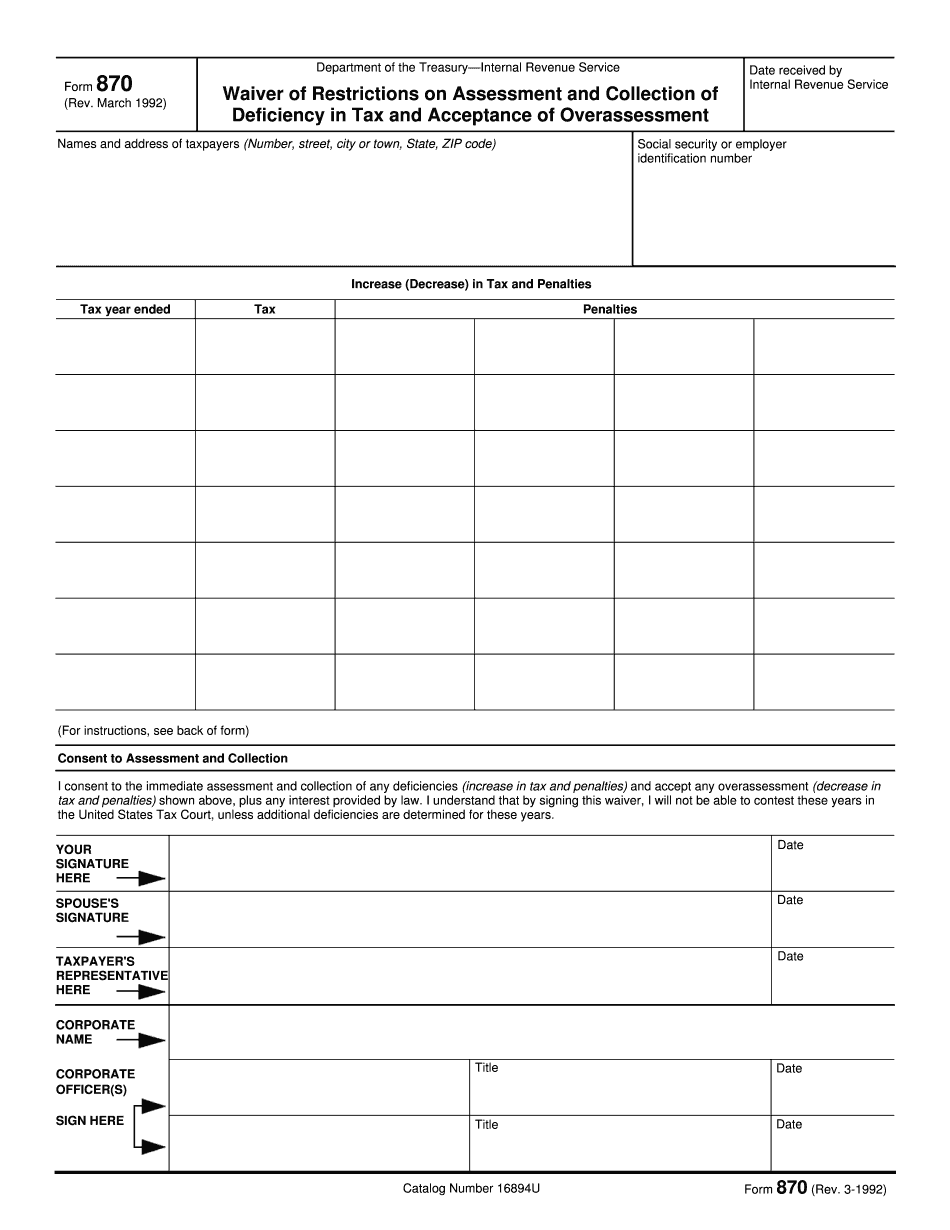

Waiver of Restrictions on Assessment by the State of Alaska — Department of Revenue Form 5635.pdf — IRS — the state of Alaska This form is used for the following purposes: (1) Assigns an exemption of gross income from Alaska taxes on the gross income for the current year and the prior two years, if this person is an alien. It does not apply to a claim based on Alaska income (Alaska income is gross income (which must have been taxable for other purposes) and includes the non-refundable interest earned on Alaska dividends. The tax commissioner can accept a waiver of the restriction on taxable income, income from other Alaska sources, or income from sources other than Alaska if the applicant is qualified under Section 12-072(1)(i)(A) or Section 12-072(8) or (4), respectively. (2) Accepts a waiver of the restriction (tax on Alaska dividends or income from any other source) if the tax commissioner is satisfied that the applicant would be likely to be able to pay such taxes in future years if the assessment was reinstated in accordance with Sec 543.51. (3) Convenes a hearing before the assessment commissioner for the purpose of determining whether to continue the assessment, including allowing an applicant who has obtained a waiver of the restriction to introduce evidence to show that he or she was likely to be able to repay the interest, penalties and late fees and to meet other reasonable conditions whether the individual can be expected to pay the full tax in future years. This waiver can also be used to request that the tax commissioner reduce the assessed amount if the tax commissioner believes that the applicant can pay the amount without undue hardship. (4) Rejects the application of the waiver if the commissioner determines that the applicant is not qualified to be allowed, is currently subject to assessment under Sec. 707 and therefore should not be allowed to use this waiver to avoid assessment, or has failed to obtain a waiver of the restriction on Alaska income or income from other Alaska sources. (5) Accepts a waiver of the restriction on Alaska dividends or income from any other source. (6) Permits the return of the taxes paid. The application must show that each person is an individual, is a citizen or national of the United States and was not entitled to a tax exemption on Alaska dividends in the last tax year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete AK Form 870, keep away from glitches and furnish it inside a timely method:

How to complete a AK Form 870?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your AK Form 870 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your AK Form 870 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.