Award-winning PDF software

Form 870 online DE: What You Should Know

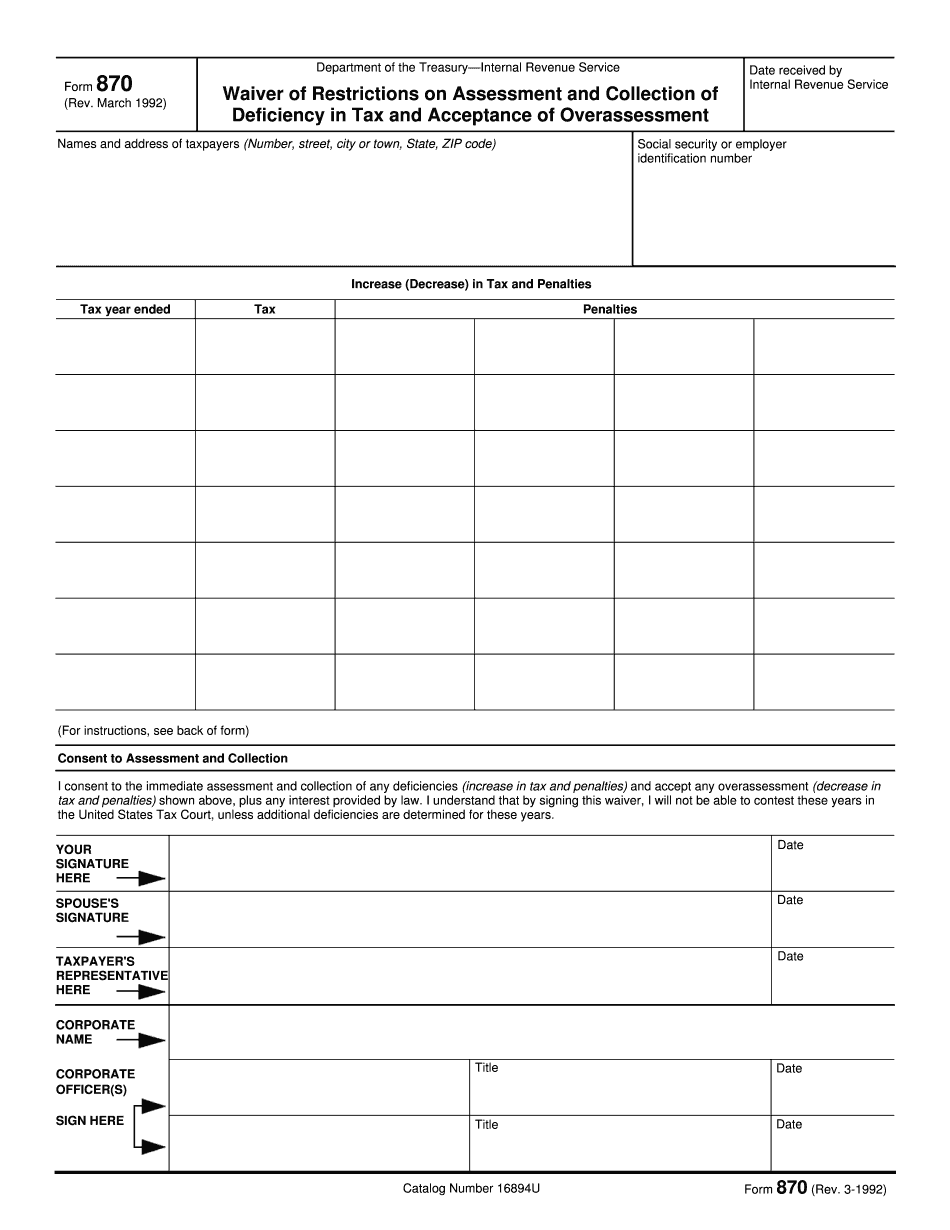

See form 870-AD form to file your request to waive restrictions on assessment and collection or accept responsibility for an adjustment in payment due from the payment of tax. Form 870-AD, Offer to Waive Limitations on Assessment and Collection of Tax 8.6.5 Revving up your return, to avoid a deficiency — IRS Jun 18, 2025 — A Form 870-EZ, Offer of Agreement is an agreement that waives some or all of the limitations or conditions on the payment of Tax in cases where the taxpayer does not make payment of such Tax within 3 months of making the agreement. It may not, however, waive the requirement for the return to be made on a specific dates to avoid a deficiency. Form 870-EZ Waiver Was Not Claim for Refund You may be entitled to the refund if you have filed Form 870-EZ within the required time (3 months) after the due date of your return, even though you did not make a timely payment of your tax because you did not have a balance to pay, so the IRS could not have assessed it. 8.6.6 Making payment in full of any deficiency — IRS Jun 24, 2025 — A Form 870-SE, Offer to Receive a Refund is an agreement that relieves the taxpayer of the need to satisfy the requirements of the Act that may have prevented payment of tax or that may have given rise to a deficiency. Form 870-SE Waiver Was Not Claimed for Refund The taxpayer is free to take advantage of the agreement without any further action by the IRS. Form 870-SE should be considered a binding agreement between the taxpayer and the IRS, that gives the taxpayer the benefit of the agreement. 8.6.7 Securing an appeal and obtaining refunds — IRS Jun 24, 2025 —A Form 860-EZ, Request to Review Agreement to Appeal and to Receive a Refund, can be used by you to file a request to have the assessment or deficiency of tax waived for any reason, provided certain requirements are met. You must have filed your return and received a deficiency determination letter within 30 days following the due date of the return or within 15 days following the date of the payment deadline, whichever is earlier.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 870 online DE, keep away from glitches and furnish it inside a timely method:

How to complete a Form 870 online DE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 870 online DE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 870 online DE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.